It was Benjamin Franklin who famously said: “By failing to prepare, you are preparing to fail.”

While there are varying thoughts in the marketplace about whether we’re heading toward a recession or not, it’s best to air on the side of caution. Following that logic and looking ahead, now is the time to take stock and align your resources to make sure that your business is ready for whatever the economy throws at us. The article below can help you do just that. It’s a long read but worth your time.

For tips about how to shore up your business for a recession, read on.

Below is an article by Kristina Russo CPA, MBA, author, for Oracle Netsuite. It appeared on their website in April 2022. We’re reprinting the article in its entirety.

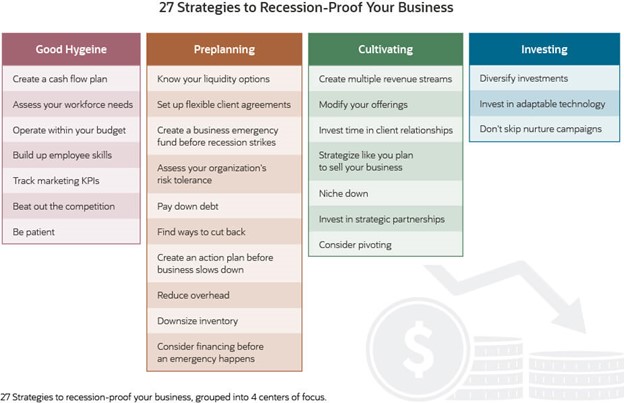

27 Strategies to Recession-Proof Your Business

When business owners and managers wear many hats and are crunched for time, the basic practices of good business hygiene often are the first to be put on the back burner, along with practices around advanced planning, cultivating long-term business strategies, and investing in growth. Yet during a recession, these practices have been known to make all the difference to a business’s success. To insulate your business against the next recession, choose the most appropriate from among these 27 strategies categorized into four buckets: good hygiene, preplanning, cultivation and investing.

GOOD HYGIENE

1. Create a cash flow plan.

Running out of cash is always a top concern for business owners, but it becomes especially important during a recession. Start by getting a handle on your current cash balances and monthly sources and uses of cash. Create a rolling cash flow forecast for the next quarter to guide the management team and serve as an early warning tool that alerts them to variances.

2. Assess workforce needs.

Take stock of the number of employees and their skills to ensure they align with what your business may need during a recession. Be ready to make adjustments so that employees work efficiently and are organized in a way that maximizes their potential.

3. Operate within your budget.

This tip is the core of good business hygiene. It makes intuitive sense to operate within your budget, so that the business is in the best possible position should a recession hit. In fact, following a budget or operating plan is a best practice at all times. Some recessions, like the one associated with the onset of the COVID-19 pandemic, come without any economic early-warning signals.

4. Build up employee skills.

You’ll need to rely on your team to help your business stay flexible, pivot, and think creatively during a recession, so it’s important that employees are in prime shape to meet these challenges. Building up skills and cross-training staff can help achieve that end. As a practical matter, investing in employees can help them feel more connected to the business and more willing to go the extra mile when they are called on to do so.

5. Track marketing key performance indicators (KPIs).

It’s critical to track marketing results and continue to monitor marketing KPIs. Only campaigns that are achieving their desired results should continue; those that aren’t should be stopped.

6. Beat the competition.

Beating the competition is a popular rallying cry for many businesses, but it takes a different turn as part of recession-proofing. Recessions have a way of weeding out certain companies as they jockey for their share of a shrinking market. Some companies can’t ride out longer recessionary periods. For these reasons, it’s important to be a market leader, collecting deep intel on your customers before a recession hits. You can start by gaining an understanding of your product’s strengths and weaknesses compared to your competitors’ — from the customer’s perspective.

7. Be patient.

Several studies indicate that medium-to-large family businesses have particular success weathering economic downturns. Their success is partially credited to multiple generations having the wisdom and experience to patiently ride out the ups and downs of many business cycles. The resulting levelheaded crisis management and long-term perspective supports their ability to be patient, as does the foundational support of lower debt levels and lack of external shareholder pressure. It’s important to remember, though, that patience and complacency are not the same. Patience has prerequisites; namely, following enough of the advice from this list to position your business to have the foundational supports that enable patience.

PREPLANNING

8. Know your liquidity options.

Investigate potential sources of capital before you’ll need to use them. Consider revolving loans, owner infusions, alternative financing, private equity and government resources, including loans backed by the Small Business Administration.

9. Establish flexible client agreements.

One way to help build customer loyalty is through negotiated flexibility, where one hand washes the other. Offer rewards in return for contracted sales volume, or customize offerings in exchange for faster payment terms. In addition to enhancing variables that help stabilize revenue streams, being flexible can create goodwill and repeat customers.

10. Create a business emergency fund.

Just as every financial planner tells individual savers to establish an emergency fund to cover personal expenses, a cash cushion is a wise business investment, too — especially for smaller companies that can’t easily tap debt markets the way a large enterprise might. Create an emergency cash fund that can cover up to six months of essential costs, including payroll, inventory and utilities. Aggressively collecting receivables can help get you started. Consider business continuity insurance as a different path to the same objective.

11. Assess your organization’s risk tolerance.

Do a gut check on how much risk your organization can handle, its risk attitude, and how much additional risk it’s willing to take on. It’s important to do an honest assessment of your leaders, your staff and your systems to determine how adaptable they are and how much risk they can absorb before cracking under pressure. Layer in the hard costs of missing goals as well as the soft costs, such as reputation management. With that background, consider how much additional risk your business is willing to take on and create a range of tolerance, along with metrics for measuring it.

12. Pay down debt.

Coming into a recession as debt-free as possible positions a company to have the highest amount of capital available to draw on in the future, should you need it. Prepayment of debt may also save some interest expenses, which can be tucked away in cash reserves (see No. 10).

13. Find ways to cut back.

Cutting back operating expenses can be a challenging task, since maintaining a product’s level of quality is particularly important during a recession. Whatever you decide to cut should be invisible to customers. When looking for ways to cut back, it’s helpful to start with the biggest costs and see if there are small tweaks that can result in big expense reductions, such as taking advantage of early pay discounts from suppliers. Other examples include automating previously manual tasks and shifting the mix of labor between full-time workers and contractors.

14. Create an action plan before business slows down.

It’s a good practice to do scenario planning and develop action plans — which can be done well before a crisis hits. Creating thoughtful action plans can help minimize errors made under stress or bad decisions made in the moment. Soliciting employee ideas can prebake their buy-in should business leaders trigger the plan.

15. Reduce overhead.

Overhead costs are expenses that remain constant regardless of revenue, so they become particularly problematic in a recession. But a slash-and-burn approach can cause more harm than good, so it’s helpful to identify three stages of overhead reductions: easy trimming, cuts that require process changes, and drastic cuts. Easy trimming might include renegotiating contracts with suppliers or changing vendors for services like office cleaning or telecommunications, or reducing or eliminating staff perks. The next stage might include eliminating travel and entertainment spending and outsourcing certain functions, both of which would necessitate changes in workflow.

Drastic overhead reductions are those that can yield the most savings but are the most disruptive. Employee layoffs, real estate consolidation and moving to a remote workforce are examples of more drastic cuts. Identifying ways to reduce overhead in advance of a recession can help with scenario planning (No. 14) and may even help find cost-saving measures that make sense regardless of macroeconomic conditions.

16. Downsize inventory.

Inventory costs money and requires careful monitoring. During a recession, when inventory turnover may be slow, inventory can become even more costly, since it becomes more susceptible to obsolescence, theft, damage, and higher costs for longer storage. While inventory managers may be predisposed to downsizing inventory to combat these costs, it’s important to maintain a balance between converting inventory to cash and retaining the ability to fulfill orders. Stockouts mean lost revenue and can impair customer relationships. Downsize the less popular, less profitable and more easily replaced inventory to increase cash flow while also evaluating the supply chain and considering stocking up on best sellers.

17. Consider financing before an emergency happens.

It’s a good idea to do some prework on financing before you need it. Some examples include appraising assets that might be used as collateral, discussing trade credit options with vendors, improving your business’ credit rating, or renegotiating extended payment terms on existing loans. Do your homework on asset-based financing, like accounts receivable financing, factoring, or purchase order financing, especially if you’ve never used them before.

CULTIVATION

18. Create multiple revenue streams.

This strategy requires some out-of-the-box thinking about how a business can tap into new revenue streams using its current infrastructure. The concept involves capturing new money without making a major investment. For example, consider whether you can add business-to-business (B2B) customers if you typically sell directly to consumers, or vice versa. Extend your geographic footprint by selling online. Or repurpose your manufacturing process for a new product. For example, a bakery could start offering take-home kits for birthday parties.

19. Modify your offerings.

Identify ways to modify an offering to make it more attractive to customers during a downturn. Modifications can be made to the product itself, how it’s delivered, or how it’s priced, in order to cater to the way customer needs might change during an economic downturn. Examples include offering new product assortments or sizes, offering services virtually or pivoting from formal dresswear to casual loungewear.

20. Invest time in client relationships.

Staying close to your customer makes sense in all economic climates and especially during a recession. Understanding their changing needs may put your business in a position to preserve revenue and even penetrate the market more deeply.

21. Strategize as if you plan to sell your business.

Many businesses rely heavily on a few key people to keep running. However, business owners should set their businesses up to survive on their own, similar to the role of parents launching capable children. One way to achieve this objective is to set up a business and its processes in a way that would continue to be successful if the company were sold to an outside entity. Often this requires changing processes, delegating authority and a lot of staff training. This idea makes sense regardless of the macroeconomic conditions, but it is especially important during a recession because it allows the business owner to steer the ship rather than row the boat.

22. Niche down.

Take a page from the recession-proof industries, whose customers continue to purchase goods and services perceived as essential. Create a similar sentiment among customers even if your product or service is not as essential as, say, ambulance services. One way to achieve this is to niche down. Niching down means to cater so much to a specific need that your business becomes the essential go-to for it. Instead of an all-purpose bakery, become a gluten-free bakery. Instead of running a sporting goods store, become a soccer store. Instead of being a realtor, be a first-time homebuyer consultant. You get the idea. But you must choose wisely: Niching down requires truly mastering the niche. Otherwise customers will become dissatisfied and alienated. It’s not an easy strategy to execute, but if it’s done well, customers will be more likely to support your business, preserving your revenue.

23. Invest in strategic partnerships.

Sometimes there can be strength in numbers. Some strategic partnerships can help make products or services more attractive to customers. Other times, it’s an unfortunate way of slicing up a smaller revenue pie. Choose partners that increase the perceived value of your product, since value, quality and durability tend to be key attributes customers seek out during hard times.

24. Consider the pivot.

In business, pivoting means adjusting your path to meet customers where they are going. Pivoting is not a wholesale change. Instead, it leverages the current business in a different way. Sometimes a pivot can be planned, but more often it involves making in-the-moment calls on the field after the market has started to decline. It can be a recession-proofing strategy or simply a way to survive the decline of a specific market. A successful pivot requires staying in close contact with customers and maintaining a willingness to step away from tried-and-true thinking. Examples of successful small business pivots can be seen in the restaurant industry, when businesses pivoted from offering fine dining experiences to boxed meals for takeaway, or cafes pivoted into small grocery stores.

INVESTING

25. Diversify investments.

At first glance, this strategy may conjure ideas of diversifying a personal investment portfolio — a good idea and applicable if the business holds investments. However, this strategy is meant to challenge business owners to think about where they have invested capital, such as fixed assets and external partnerships. Analyze the return on investments for current holdings and consider shifting funds to existing and new investments with higher returns. For example, there may be opportunities to purchase new machinery or even another firm at a bargain price.

26. Invest in adaptable technology.

The right technology can help keep a business running during challenging times while also saving money. It’s best to have technology installed and tested in advance to avoid costly or embarrassing errors during a crisis. For example, having the technology in place to change distribution methods, such as switching over to virtual delivery, allows service businesses to earn revenue when physical or in-person delivery isn’t an option, such as for tutoring, performances and publishing. Similarly, online ordering and contactless payment technology can help customers continue to buy products from restaurants and retailers. Such technologies can be a permanent addition, giving customers another way to interact with a business.

27. Don’t skip nurture campaigns.

Since a key focus of recession-proofing is preserving revenue, it’s important to continue marketing and promotion efforts. Loyalty campaigns geared toward recapturing past customers or increasing penetration with current customers can help keep the customer base healthy. Often, it’s more costly to find new customers than to stimulate current ones. Targeted promotions, especially those that align with customer pain points, can help increase market share if competitors go dark.

At Shamrock, we try to follow these rules for our own business. And we also help our clients remain competitive and position their businesses to weather challenges like a recession. For example, we use a digital marketing asset management tool to help them better manage their marketing programs—our digital interface gives them the vision and control they need to manage inventory, reduce obsolete materials, cut costs. By using real-time data, they’re able to make more informed business decisions.

During times like these, it’s essential that we share the resources that we have to help all our businesses thrive. If you’ve got tips and insights that you’d like to share, please reach out. We’re always open to new ideas.